Top 10 Open Finance–Driven Insurtech Opportunities in the UAE

| App Idea | Description | Leverages Open Finance | Revenue Model | Target Market |

|---|---|---|---|---|

| Personalized Insurance Marketplace | Aggregates insurance products, offers tailored recommendations using analytics. | Access to policy data and provider information | Commissions, subscription fees | Expatriates, residents |

| Automated Claims Processing App | Streamlines claims with AI, pre-fills forms using policy data. | Access to policy and claims data | B2B fees, B2C premium features | Policyholders, insurers |

| Usage-Based Insurance App | Offers pay-per-mile auto or pay-per-use home insurance, potentially using IoT. | Potential integration with usage data | Subscription-based premiums | Cost-conscious users |

| Health Insurance and Wellness App | Personalized plans with wellness tracking, leveraging health-related data. | Access to health financial data | Commissions, partnerships | Health-conscious, employers |

| Travel Insurance Automation | Generates quotes based on itineraries, integrates with booking platforms. | Facilitates transaction initiation | Commissions on sales | Travelers, tourists |

| Fraud Detection and Prevention Platform | Uses AI on claims data to detect fraud, offered as a service to insurers. | Access to claims data | Service fees from insurers | Insurance companies |

| Customer Engagement and Policy Management App | Unified platform for managing policies and claims in real-time. | Real-time policy and claims data access | Subscription fees, partnerships | Policyholders across all types |

| Microinsurance for Gig Workers | Affordable insurance for gig economy workers, using financial data for risk. | Access to financial data for risk assessment | Subscription premiums, commissions | Gig workers (e.g., drivers) |

| Regulatory Compliance Tool for Insurers | Helps insurers manage API integrations and regulatory reporting. | Access to API documentation and standards | B2B service fees | Insurance companies |

| AI-Powered Risk Assessment App | Analyzes data to improve underwriting efficiency for insurers. | Access to financial and behavioral data | Service fees from insurers | Insurance companies |

Key Points

- Research suggests open finance APIs in the UAE can support insurtech apps by enabling data sharing and transaction initiation.

- It seems likely that apps targeting high-demand areas like travel insurance or personalized marketplaces could reach 1 million AED quickly.

- The evidence leans toward leveraging the Open Finance Framework for scalable revenue models like commissions or subscriptions.

Introduction

The Open Finance UAE framework, introduced by the Central Bank of the UAE (CBUAE), offers a promising landscape for developing insurtech apps. By leveraging open insurance APIs, you can create innovative solutions that tap into the UAE's diverse market, including expatriates, tourists, and gig workers. Below, I’ll outline key ideas for starting ten insurtech apps with the potential to reach 1 million AED quickly, followed by a detailed survey of the reasoning and supporting information.

Why Open Finance Matters for Insurtech

The Open Finance Regulation, effective from April 23, 2024, includes both open banking and open insurance components, facilitating secure data sharing and transaction initiation. This framework is part of the CBUAE’s Financial Infrastructure Transformation Programme, aiming to foster innovation and competition. For insurtech, this means access to insurance policy data, claims history, and customer information, which can be used to build apps that enhance customer experience and operational efficiency.

Ten Insurtech App Ideas

Here are ten ideas for insurtech apps that can leverage the Open Finance Framework to scale rapidly:

- Personalized Insurance Marketplace: Aggregate insurance products and offer tailored recommendations using data analytics.

- Automated Claims Processing App: Streamline claims with AI, pre-filling forms using policy data.

- Usage-Based Insurance App: Offer pay-per-mile auto or pay-per-use home insurance, potentially integrating IoT data.

- Health Insurance and Wellness App: Provide personalized plans with wellness tracking, leveraging health-related financial data.

- Travel Insurance Automation: Automatically generate quotes based on travel itineraries, integrating with booking platforms.

- Fraud Detection and Prevention Platform: Use AI on claims data to detect fraud, offering services to insurers.

- Customer Engagement and Policy Management App: Unified platform for managing policies and claims in real-time.

- Microinsurance for Gig Workers: Affordable insurance for ride-sharing drivers and freelancers, using financial data for risk assessment.

- Regulatory Compliance Tool for Insurers: Help insurers manage API integrations and regulatory reporting.

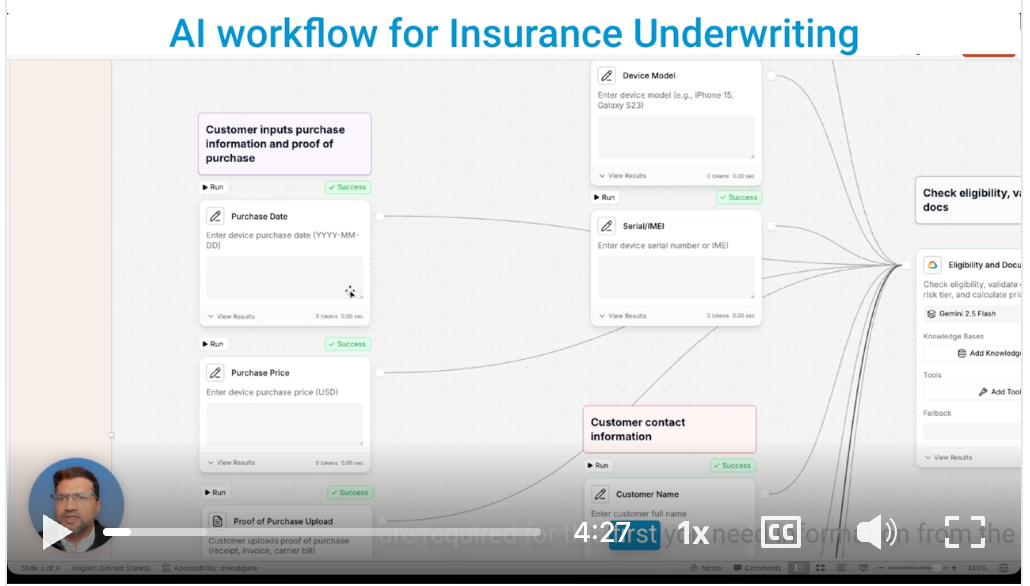

- AI-Powered Risk Assessment App: Analyze data to improve underwriting efficiency for insurers.

Revenue and Scalability

To reach 1 million AED quickly, focus on scalable revenue models:

- Commissions: Earn from insurance sales (e.g., marketplaces, travel insurance).

- Subscriptions: Charge for premium features (e.g., automated claims, policy management).

- B2B Services: Offer high-value solutions like fraud detection or compliance tools to insurers.

Target high-demand segments like travelers, health-conscious individuals, or gig workers to ensure rapid user acquisition.

Background on Open Finance UAE

The Open Finance Regulation, introduced by the Central Bank of the UAE (CBUAE) on April 23, 2024, establishes an Open Finance Framework that incorporates both open banking and open insurance components .

This framework is part of the CBUAE’s Financial Infrastructure Transformation Programme, aiming to foster innovation, healthy competition, and service improvement across the financial landscape . It facilitates cross-sectoral sharing of data and initiation of transactions on behalf of customers, with a focus on secure and standardized API-based interactions.

Key components of the framework include:

- Trust Framework: Comprises a Participant Directory, Digital Certificates for secure communication, an API Portal for documentation, and a Sandbox for testing.

- API Hub: A centralized platform enabling access to accounts and services via aggregated APIs, ensuring interoperability and secure communication.

- Common Infrastructural Services: Includes tools like a Consent and Authorisation Manager for managing user consents, ensuring compliance with privacy directives.

The framework’s open insurance component is particularly relevant for insurtech, as it allows third-party providers to access insurance-related data (e.g., policy details, claims history) and initiate transactions, subject to user consent.

This aligns with global trends in open finance, where APIs are used to drive innovation and improve customer experience .

Market Context in the UAE

The UAE’s financial services sector is dynamic, with a diverse population including expatriates, tourists, and a growing middle class. This diversity creates demand for innovative insurance products, particularly in areas like travel, health, and gig economy services.

The country’s emphasis on digital transformation and fintech innovation, as evidenced by the CBUAE’s initiatives, provides a fertile ground for insurtech apps. Given the current date (May 30, 2025), the Open Finance Framework is likely in an advanced stage of implementation, with banks and insurers already onboarding, as per phased rollout plans .

Generating Insurtech App Ideas

To develop insurtech apps that can reach 1 million AED in revenue, quickly, the focus is on leveraging the Open Finance Framework for data access and transaction initiation, targeting high-demand use cases, and ensuring scalable revenue models. Below are ten ideas, categorized by their potential use cases and revenue strategies:

Detailed Analysis of Each Idea

Personalized Insurance Marketplace:

- This app aggregates insurance products from multiple providers, using data analytics to offer personalized recommendations. It leverages open insurance APIs to access policy data and provider information, similar to how open banking APIs enable account aggregation. Given the UAE’s competitive insurance market, this could attract users seeking tailored solutions, with revenue from commissions on sales or subscription fees for premium features.

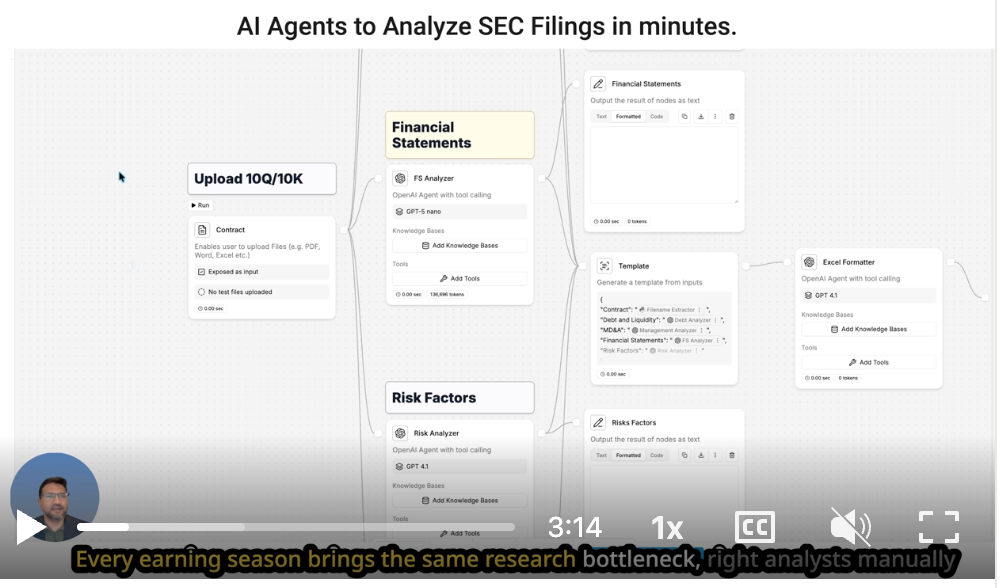

Automated Claims Processing App:

- By integrating with insurers’ systems via the API Hub, this app pre-fills claim forms with policy data and uses AI to expedite approvals. This reduces processing times, improving customer satisfaction and insurer efficiency. Revenue could come from B2B fees for insurers or B2C premium features for faster processing, targeting both policyholders and insurance companies.

Usage-Based Insurance App:

- This innovative model offers premiums based on actual usage, such as pay-per-mile auto insurance or pay-per-use home insurance. While open finance APIs may not directly provide IoT or telematics data, they could integrate with external sources, enabling this model. It appeals to cost-conscious users, with revenue from subscription-based premiums.

Health Insurance and Wellness App:

- This app integrates with health-related financial data (if permitted) to offer personalized plans and wellness programs, including fitness tracking and preventive care reminders. Given growing health awareness in the UAE, it could partner with employers or health providers, with revenue from commissions or partnerships.

Travel Insurance Automation:

- Targeting the significant travel industry in the UAE, this app automatically generates quotes based on travel itineraries, integrating with booking platforms. Open finance APIs facilitate transaction initiation, and revenue comes from commissions on sales, with high potential among frequent travelers and tourists.

Fraud Detection and Prevention Platform:

- Using AI on claims data accessed through open insurance APIs, this platform detects fraudulent claims, offered as a B2B service to insurers. It reduces losses, with high-value potential, and revenue from service fees, scalable through partnerships with multiple insurers.

Customer Engagement and Policy Management App:

- A unified platform for managing policies and claims in real-time, this app improves customer retention by simplifying interactions. It leverages real-time data access via APIs, with revenue from subscription fees or partnerships with insurers, appealing to policyholders across all insurance types.

Microinsurance for Gig Workers:

- This app offers affordable insurance for gig economy workers, using financial data for risk assessment. Given the growing gig economy, it addresses an underserved market, with revenue from subscription premiums or commissions, scalable through targeted marketing.

Regulatory Compliance Tool for Insurers:

- As the Open Finance Framework rolls out, insurers need tools to manage API integrations and regulatory reporting. This app helps with compliance, leveraging access to API documentation and standards, with revenue from B2B service fees, targeting a niche but high-value market.

AI-Powered Risk Assessment App:

- This app analyzes financial, behavioral, and other data to improve underwriting efficiency for insurers, leveraging open finance APIs for data access. It offers a high-value B2B solution, with revenue from service fees, scalable across different insurance types.

Considerations for Success

To ensure these ideas are feasible and scalable, consider the following:

- Data Availability: Confirm that the Open Finance Framework provides access to necessary insurance data (e.g., policy details, claims history) through its APIs. The API Portal, part of the Trust Framework, holds documentation on standards and technical specifications.

- Regulatory Compliance: All apps must adhere to the UAE’s open finance regulations and data protection laws, ensuring user consent and secure data handling as outlined in the framework.

- Market Demand: Focus on high-demand segments like expatriates, tourists, gig workers, or health-conscious individuals, given the UAE’s diverse population and economic activities.

- Scalability: Prioritize apps with scalable revenue models, such as commissions on sales (e.g., marketplaces, travel insurance), subscriptions (e.g., automated claims, policy management), or B2B services (e.g., fraud detection, compliance tools).

- Partnerships: Collaborate with insurance providers, travel platforms, or health services to enhance data access and user acquisition, leveraging the framework’s interoperability features.

Fully Feasible App Ideas (based on Nebras APIs)

These apps can be built primarily using the provided Open Finance API endpoints without significant additional development outside the API’s scope:

Personalized Insurance Marketplace

- Description: An app that aggregates insurance products from multiple providers and offers tailored recommendations based on user preferences.

- Why Feasible: The API provides endpoints to create and retrieve quotes for various insurance types (e.g., /employment-insurance-quotes, /health-insurance-quotes, /travel-insurance-quotes). You can use these to fetch quotes, compare them, and personalize offerings based on user input. Policy details can also be accessed via /[insurance-type]-insurance-policies.

- Key Endpoints:

- POST /[insurance-type]-insurance-quotes (create quotes)

- GET /[insurance-type]-insurance-quotes/{QuoteId} (retrieve quotes)

- GET /[insurance-type]-insurance-policies (retrieve policies)

- Conclusion: Fully implementable as the API supports quote aggregation and policy retrieval, the core features needed.

Travel Insurance Automation

- Description: An app that automatically generates travel insurance quotes based on travel itineraries.

- Why Feasible: The API includes specific endpoints for travel insurance (e.g., /travel-insurance-quotes), allowing quote creation and retrieval based on trip details provided in the request body (e.g., destination, duration). Policies can then be created using /travel-insurance-policies.

- Key Endpoints:

- POST /travel-insurance-quotes (create travel quotes)

- GET /travel-insurance-quotes/{QuoteId} (retrieve quotes)

- POST /travel-insurance-policies (create policies)

- Conclusion: Fully supported, as the API handles the entire quote-to-policy workflow for travel insurance.

Microinsurance for Gig Workers

- Description: An app offering affordable, tailored insurance for gig workers (e.g., short-term employment or renters insurance).

- Why Feasible: The API supports creating and managing policies for various insurance types (e.g., /employment-insurance-policies, /renters-insurance-policies).

- The microinsurance aspect—small, flexible policies—can be achieved through product design within the app, using the API’s standard policy management features.

- Key Endpoints:

- POST /[insurance-type]-insurance-policies (create policies)

- GET /[insurance-type]-insurance-policies (retrieve policies)

- Conclusion: Fully feasible, as the API provides the necessary policy management tools, and microinsurance can be implemented through pricing and coverage customization.

Partially Feasible App Ideas

These apps can leverage the Open Finance APIs for core functionalities but require additional features or integrations beyond the API’s current capabilities:

Automated Claims Processing App

- Description: An app that streamlines claims by pre-filling forms using policy data and submitting claims.

- Why Partially Feasible: The API provides policy details (e.g., /[insurance-type]-insurance-policies/{InsurancePolicyId}), which can pre-fill claims forms. However, it lacks endpoints for submitting or processing claims directly.

- Key Endpoints:

- GET /[insurance-type]-insurance-policies/{InsurancePolicyId} (policy details)

- Additional Needs: Claims submission and processing APIs or integrations with insurers’ systems.

- Conclusion: The API supports data retrieval, but claims functionality requires external development.

Health Insurance and Wellness App

- Description: An app offering personalized health insurance plans integrated with wellness tracking (e.g., fitness data).

- Why Partially Feasible: The API supports health insurance policy and quote management (e.g., /health-insurance-policies, /health-insurance-quotes), covering the insurance side. However, it doesn’t integrate with wellness tracking systems.

- Key Endpoints:

- POST /health-insurance-quotes (create quotes)

- POST /health-insurance-policies (create policies)

- Additional Needs: Integration with fitness trackers or health apps (e.g., Fitbit, Apple Health).

- Conclusion: Insurance features are supported, but wellness tracking requires additional integrations.

Customer Engagement and Policy Management App

- Description: A unified platform for users to manage policies, view payment details, and engage with insurers.

- Why Partially Feasible: The API allows retrieving policy details (e.g., /[insurance-type]-insurance-policies) and payment information (e.g., /[insurance-type]-insurance-policies/{InsurancePolicyId}/payment-details), supporting policy management. However, claims management and real-time engagement (e.g., chat) aren’t included.

- Key Endpoints:

- GET /[insurance-type]-insurance-policies (list policies)

- GET /[insurance-type]-insurance-policies/{InsurancePolicyId}/payment-details (payment info)

- Additional Needs: Claims management endpoints and real-time communication features.

- Conclusion: Policy management is fully supported, but additional features need separate implementation.

Regulatory Compliance Tool for Insurers

- Description: An app helping insurers manage API integrations and generate regulatory reports.

- Why Partially Feasible: The API provides endpoints for integration (e.g., policy and quote management), but it doesn’t include regulatory reporting or compliance-specific features.

- Key Endpoints: All policy and quote endpoints for integration.

- Additional Needs: Logic for regulatory reporting and compliance checks (e.g., UAE insurance regulations).

- Conclusion: Integration is feasible, but compliance functionality must be built separately.

AI-Powered Risk Assessment App

- Description: An app using AI to analyze customer data for better underwriting efficiency.

- Why Partially Feasible: The API provides policy and customer data (e.g., /[insurance-type]-insurance-policies), which can feed AI models. However, the AI risk assessment logic isn’t part of the API.

- Key Endpoints:

- GET /[insurance-type]-insurance-policies (policy data)

- Additional Needs: Development of AI models for risk analysis.

- Conclusion: Data access is sufficient, but AI implementation is external.

Limited Feasibility App Ideas

These apps require significant functionality not provided by the Nebras APIs, making them challenging to implement solely with the given specification:

Usage-Based Insurance App

- Description: An app offering insurance based on real-time usage (e.g., pay-per-mile motor insurance).

- Why Limited: The API focuses on standard policy and quote management (e.g., /motor-insurance-policies) but doesn’t support real-time usage data or IoT device integration.

- Key Endpoints:

- POST /motor-insurance-policies (create policies)

- Additional Needs: IoT integration (e.g., telematics devices) and usage data processing.

- Conclusion: The API handles policies but not the usage-based core feature.

Fraud Detection and Prevention Platform

- Description: An app using AI to detect fraudulent claims.

- Why Limited: The API provides claims history via policy details (e.g., /[insurance-type]-insurance-policies), but it lacks fraud detection tools or real-time monitoring.

- Key Endpoints:

- GET /[insurance-type]-insurance-policies (policy and claims data)

- Additional Needs: AI fraud detection models and real-time transaction analysis.

- Conclusion: Data is available, but fraud detection requires significant external development.

Summary

- Fully Feasible:

- Personalized Insurance Marketplace

- Travel Insurance Automation

- Microinsurance for Gig Workers

- Partially Feasible:

- Automated Claims Processing App

- Health Insurance and Wellness App

- Customer Engagement and Policy Management App

- Regulatory Compliance Tool for Insurers

- AI-Powered Risk Assessment App

- Limited Feasibility:

- Usage-Based Insurance App

- Fraud Detection and Prevention Platform

The UAE Insurance API provides a strong foundation for policy and quote management, making it ideal for apps focused on aggregation, automation, and basic policy handling.

For advanced features like claims processing, real-time data, or AI-driven insights, you’ll need to supplement the API with additional integrations or custom development.

Conclusion

The Open Finance UAE framework provides a robust foundation for developing insurtech apps, with its open insurance component enabling data sharing and transaction initiation.

The ten ideas listed above, ranging from personalized marketplaces to AI-powered risk assessment, offer diverse opportunities to tap into the UAE’s growing insurtech market.

By targeting high-demand use cases and ensuring scalable revenue models, these apps have the potential to reach 1 million AED in revenues quickly, aligning with the framework’s goals of innovation and competition.

Key Citations

- New fintech regulations in the United Arab Emirates Open Finance Regulation | DLA Piper

- Open Finance Regulation | CBUAE Rulebook

- UAE Central Bank Implements Open Finance Framework - Bird & Bird

- Open Banking in the United Arab Emirates | Open Bank Project

- Open Finance in the UAE: Policies and Players Powering the Shift - WhiteSight

Book an appointment with us to see how we can help your insurance business.