The Essential Guide to AI Agents

What is an AI agent, and how does it differ from chatbots or AI assistants?

An AI agent is an autonomous software program or system designed to perceive its environment, process information, make decisions, and take actions to achieve specific, predetermined goals without constant human supervision.

They leverage machine learning and natural language processing to understand context and handle nuanced inquiries, continuously optimizing their responses through learning.

Unlike simpler systems:

• Chatbots are basic interfaces primarily designed to respond to user queries based on predefined scripts or keywords. They are reactive and have limited decision-making capabilities.

• AI Assistants are AI agents designed as applications to collaborate directly with users, understanding and responding to natural language. They can recommend actions, but the user typically makes the final decision, making them less autonomous than full AI agents.

AI agents stand out due to their higher degree of autonomy, ability to handle complex, multi-step tasks, and capacity to learn and adapt over time.

What are the core components and operational cycle of an AI agent?

AI agents operate through a continuous cycle of perception, decision-making, action, and learning, underpinned by a distinct architecture.

Core Components:

• Architecture: This is the underlying hardware or system on which the agent operates (e.g., robotic arms, sensors, cameras for physical agents, or APIs and databases for software agents).

• Agent Program: This is the software component that defines the agent's behavior, implementing the agent function (how percepts translate into actions). It includes:

◦ Profiling Module: Helps the agent understand its role and purpose by gathering environmental information.

◦ Memory Module: Stores and retrieves past experiences, enabling the agent to learn and maintain context (short-term, long-term, episodic, consensus).

◦ Planning Module: Responsible for decision-making, evaluating situations, weighing alternatives, and selecting effective courses of action.

◦ Action Module: Executes the decisions, translating them into real-world or digital actions.

• Tools: External resources or functions an agent can use to interact with its environment (e.g., accessing information, manipulating data, controlling systems).

• Model (often LLMs): Large Language Models serve as the "brain," enabling understanding, reasoning, and language generation from various input modalities.

Operational Cycle:

1. Perception & Input Processing: Agents gather and interpret data from their environment through sensors or data collection mechanisms, converting raw inputs into an understandable format.

2. Decision-Making & Planning: Using machine learning models and knowledge bases (often enhanced by RAG), agents evaluate inputs against objectives, consider possibilities, and select the most appropriate actions or sequences of actions.

3. Action Execution: Once a decision is made, agents execute tasks through their output interfaces, which can involve generating responses, updating databases, or triggering workflows.

4. Learning & Adaptation: Advanced agents continuously improve by analyzing action outcomes, updating their knowledge bases, and refining decision-making processes based on feedback (often using reinforcement learning).

What are the main benefits and challenges associated with deploying AI agents in business?

Benefits of AI Agents:

• Increased Efficiency & Productivity: Automate repetitive and complex tasks, freeing human employees for more strategic work.

• Improved Accuracy: Analyze patterns and make data-driven decisions with higher precision, reducing human error.

• Real-time Decision-Making: Process vast amounts of data quickly to make informed decisions in dynamic environments.

• Personalization: Tailor experiences (e.g., product recommendations, support) based on individual factors and preferences.

• Scalability: Handle large volumes of tasks simultaneously, making them ideal for scaling operations.

• Cost Savings: Reduce operational costs by automating tasks and improving overall efficiency.

• Learning & Adaptability: Continuously improve performance over time by learning from experiences and integrating new feedback.

Challenges of AI Agents:

• Computational Costs & Resources: Require significant computing power, storage, and specialized staff for deployment and maintenance, leading to sizable upfront investments.

• Human Training & Oversight: Despite autonomy, they need human training, calibration, and continuous oversight to ensure proper operation and model updates.

• Integration Difficulties: Not all AI agent types are compatible for hybrid or multi-agent systems, requiring rigorous testing before deployment to avoid costly errors.

• Infinite Loops: Agents, particularly simpler ones, can get stuck in endless action chains if not properly designed for partially observable or dynamic environments.

• Data Privacy & Ethical Concerns: Handling massive datasets raises privacy issues, and deep learning models can produce biased or inaccurate results if safeguards are not in place.

• Technical Complexities: Implementing advanced agents requires specialized ML expertise for integration, training, and deployment.

• Tasks Requiring Deep Empathy/Emotional Intelligence: AI agents struggle with nuanced human emotions, therapy, social work, or conflict resolution.

• Situations with High Ethical Stakes: They lack the moral compass for ethically complex scenarios like law enforcement or judicial decision-making.

• Unpredictable Physical Environments: Difficulties arise in highly dynamic environments requiring real-time adaptation and complex motor skills (e.g., surgery, disaster response).

How are AI agents classified based on their decision logic?

AI agents are classified by their decision logic, which defines how they process information, evaluate options, and select actions. This highlights their varying levels of autonomy and capability:

1. Simple Reflex Agents:

◦ Decision Logic: Act based on predefined "if-then" rules in response to current sensory input, ignoring past actions or future outcomes.

◦ Characteristics: Basic, efficient, and easy to implement in environments with clear, consistent rules.

◦ Example: A thermostat turning on heat if the temperature drops below a set point; email auto-responders flagging fraud.

◦ Limitation: Lack memory and adaptability, can get stuck in infinite loops in partially observable environments.

2. Model-Based Reflex Agents:

◦ Decision Logic: Create and maintain an internal "model" of their environment, allowing them to consider past states and adapt to partially observable environments.

◦ Characteristics: Smarter than simple reflex agents due to internal memory (the "model"); can predict how actions affect the environment.

◦ Example: Smart home security systems distinguishing routine events from threats; loan processing agents tracking applicant profiles.

◦ Limitation: Increased complexity and computational requirements; limited by the accuracy of the internal model.

3. Goal-Based Agents:

◦ Decision Logic: Make decisions aimed at achieving a specific, predefined outcome, evaluating actions to find those that move them closer to their goals.

◦ Characteristics: Plan sequences of actions, versatile for tasks with multiple possible paths.

◦ Example: GPS navigation systems finding optimal delivery routes; industrial robots following assembly sequences.

◦ Limitation: Requires well-defined goals; complex to design for multi-step tasks or conflicting objectives.

4. Utility-Based Agents:

◦ Decision Logic: Work towards goals while maximizing a "utility" or preference scale, choosing actions that yield the best overall outcome among multiple solutions.

◦ Characteristics: Handle trade-offs between competing goals by assigning numerical values to outcomes ("happiness" or desirability).

◦ Example: Financial portfolio management agents balancing risk and return; resource allocation systems optimizing efficiency and output.

◦ Limitation: Requires a carefully designed utility function; computationally intensive due to evaluation of multiple factors.

5. Learning Agents:

◦ Decision Logic: Adapt and improve their behavior over time based on experience and feedback, using machine learning to adjust actions and enhance future performance.

◦ Characteristics: Predictive, continuously refine strategies, and can operate in environments where optimal behavior isn't known beforehand.

◦ Example: E-commerce recommendation engines refining suggestions based on user interactions; customer service chatbots improving response accuracy over time.

◦ Limitation: Requires large datasets and feedback for effective learning; can be computationally intensive; risk of overfitting.

What are Multi-Agent Systems (MAS) and Hierarchical Agents, and how do they differ?

Both Multi-Agent Systems (MAS) and Hierarchical Agents involve multiple AI agents, but they differ significantly in their structure and coordination:

1. Multi-Agent Systems (MAS):

◦ Definition: Consist of several AI agents working collaboratively or competitively within a shared environment. Each agent has specialized tasks or individual goals.

◦ How They Work: Agents interact through communication protocols and follow defined interaction rules. They can be cooperative (sharing information for common goals) or competitive (competing for resources). Coordination mechanisms organize activities and prevent conflicts.

◦ Characteristics: Scalable and well-suited for tasks requiring dynamic responses to varied inputs. Offers redundancy and robustness (if one agent fails, others can continue).

◦ Examples: Smart city traffic management systems where agents manage traffic lights and monitor congestion; multiple robots coordinating to move items in a warehouse.

◦ Limitations: Coordination can be complex; potential for conflicts if goals compete; efficient resource management across agents is challenging.

2. Hierarchical Agents:

◦ Definition: Operate across different levels, where higher-level agents manage and direct the actions of lower-level agents within a structured hierarchy.

◦ How They Work: Complex tasks are broken down into manageable subtasks. High-level agents set broader objectives and delegate specific tasks to lower-level agents, which then execute them and report progress. This creates a top-down workflow.

◦ Characteristics: Organized structure simplifies complex operations; allows for better resource allocation and task division.

◦ Examples: Quality control in manufacturing where low-level agents inspect items and high-level agents analyze patterns for overall production quality; autonomous drone operations where a high-level agent manages route optimization and low-level agents handle navigation.

◦ Limitations: Can be rigid, potentially limiting adaptability if strict hierarchies are enforced; requires effective communication between levels for efficiency.

Key Difference: MAS emphasize interaction and collaboration among agents that might be largely independent, whereas Hierarchical Agents impose a strict, tiered management structure, with clear delegation and oversight from higher-level to lower-level agents.

What are the different functional roles AI agents play within businesses?

AI agents can be categorized by their functional roles within businesses, each designed to support specific operations:

1. Customer Agents:

◦ Role: Engage with users, answer inquiries, and handle routine customer service tasks 24/7.

◦ Capabilities: Use Natural Language Processing (NLP) for conversational interactions, provide seamless support, and can route complex issues to human agents.

◦ Examples: Virtual assistants for billing inquiries or product troubleshooting; Volkswagen's virtual assistant for driver questions.

2. Employee Agents:

◦ Role: Assist with HR, administrative, and productivity tasks, enabling employees to focus on strategic responsibilities.

◦ Capabilities: Automate routine activities like onboarding, schedule management, and training.

◦ Examples: Onboarding agents guiding new hires through paperwork and training; Uber's agents optimizing driver onboarding by automating background checks.

3. Creative Agents:

◦ Role: Support content creation by generating text, images, or video content.

◦ Capabilities: Leverage generative AI models to produce outputs consistent with brand guidelines and tone; assist marketing teams with drafting social media posts or ad copy.

◦ Examples: AI agents for resume writing; PUMA leveraging Imagen to generate customized product photos for local markets.

4. Data Agents:

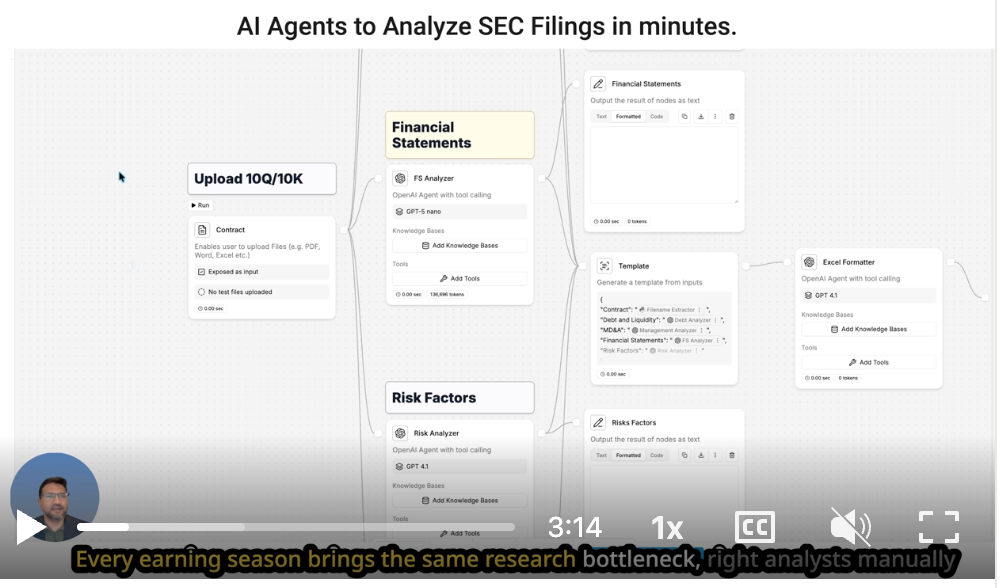

◦ Role: Handle large-scale data processing tasks, from cleaning to analytics, extracting insights from massive datasets.

◦ Capabilities: Work as information retrieval agents, helping businesses make data-driven decisions quickly; can translate natural language into SQL commands for non-technical users.

◦ Examples: Financial institution agents processing real-time market data for predictive insights; agents enabling sales reps to extract data from databases quickly.

5. Code Agents:

◦ Role: Assist software developers in creating and maintaining applications and systems.

◦ Capabilities: Streamline tasks like bug detection and resolution, recommending code optimizations, and generating code snippets from natural language inputs.

◦ Examples: Google Cloud's Vertex AI Agent Builder for developing AI assistants with minimal coding; GitHub Copilot accelerating coding processes.

6. Security Agents:

◦ Role: Continuously monitor systems, detect anomalies, and respond to threats in real-time, enhancing organizational security and mitigating risks.

◦ Capabilities: Analyze patterns in behavior to detect fraudulent transactions; assist Security Operations Center (SOC) teams with threat detection and investigation.

◦ Examples: Banking security agents flagging suspicious activity; Microsoft Security Copilot enhancing threat detection and response for SOC teams.

What are emerging types and hybrid agents, and how do they benefit businesses?

As AI technology evolves, new types of AI agents and hybrid models are emerging, combining the strengths of existing agent types to address more complex challenges that demand adaptability, optimization, and decision-making across dynamic environments.

What are Hybrid Agents?

Hybrid agents integrate features from multiple agent types, allowing them to balance competing objectives, conduct long-term planning, and adapt in real-time. They are particularly useful when achieving a goal must be done in the most efficient or beneficial way.

Emerging Hybrid Models:

1. Goal-Utility Hybrids: These agents prioritize predefined goals but evaluate each action based on its utility (e.g., efficiency, safety, cost), optimizing the approach to goal attainment.

◦ Example: Logistics agents ensuring delivery (goal) while minimizing fuel consumption and delivery time (utility).

2. Learning-Utility Hybrids: Integrate learning capabilities with utility-based decision-making, enabling agents to adapt and improve strategies over time while continuously striving for optimal results.

◦ Example: Stock trading agents learning market patterns and dynamically adjusting utility functions to balance risk and reward.

3. Multi-Modal Agents: Combine different input modalities (visual, auditory, text-based data) to make more comprehensive and accurate decisions.

◦ Example: Autonomous vehicles integrating road visuals, GPS data, and real-time traffic updates for route optimization.

4. Collaborative Hybrid Systems: Involve multiple agents, each potentially with hybrid capabilities, working together in often decentralized environments.

◦ Example: Swarm robotics for disaster recovery, where individual robots balance local goals and utilities while contributing to a larger mission.

Benefits to Businesses:

• Enhanced Decision-Making: Enable sophisticated decisions by balancing multiple objectives and making optimal choices under uncertainty.

• Greater Adaptability: More responsive to dynamic environments, continuously learning and refining strategies.

• Increased Efficiency: Streamline complex operations by optimizing for multiple factors simultaneously (e.g., speed, cost, quality).

• Complex Problem Solving: Tackle challenges that require a blend of planning, optimization, and real-time responsiveness.

• Transformative Potential: Unlock new possibilities in personalized medicine, smart city management, advanced e-commerce, and efficient manufacturing by bridging the gap between efficiency, adaptability, and complex decision-making.

Where are AI agents commonly applied in real-world scenarios?

AI agents are revolutionizing various industries by automating workflows, improving decision-making, and enhancing experiences:

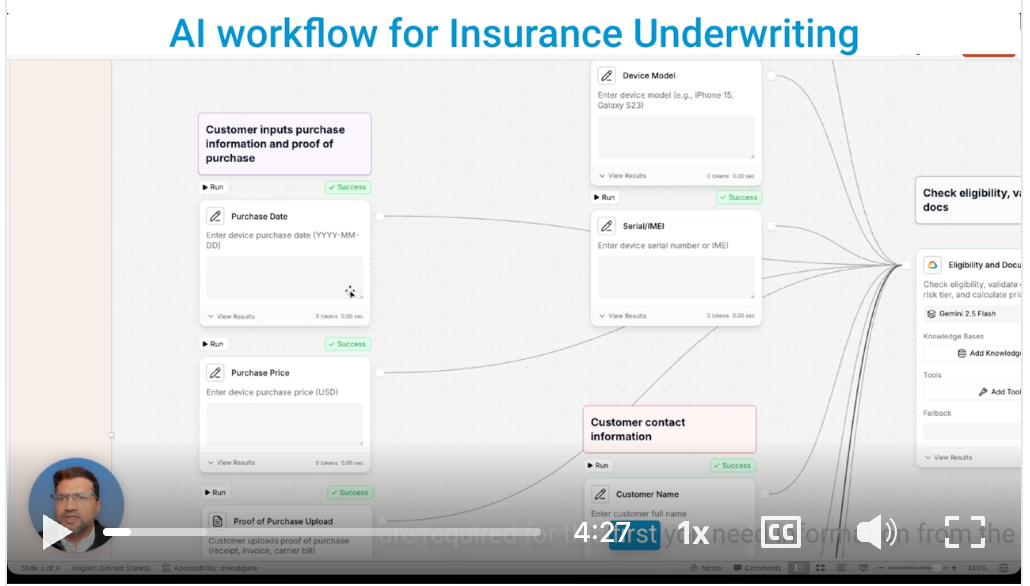

• Finance and Insurance:

◦ Automation: Automate end-to-end workflows (e.g., payments, credit rating, claims processing, loan underwriting), accelerating turnaround times.

◦ Fraud Detection: Analyze patterns in customer behavior and transactions to flag and block suspicious activity in real-time.

◦ Investment Advice: Analyze market data and provide personalized investment advice.

◦ Risk Assessment: Assess risk and provide policy recommendations based on real-time and historical patterns.

• Customer Service and Support:

◦ Conversational AI: Streamline inquiries, troubleshoot issues, and provide real-time solutions via chatbots and virtual agents, reducing wait times and human workload.

◦ Personalization: Offer interactive support, answer billing questions, and provide product troubleshooting.

• Manufacturing and Robotics:

◦ Workflow Automation: Control robots and automate tasks in assembly lines, quality control, and warehouse management.

◦ Logistics: Optimize delivery routes based on factors like distance, time, traffic, and battery life.

◦ Quality Control: Inspect individual items and analyze data to identify patterns and improve production quality.

• Healthcare:

◦ Workflow Streamlining: Schedule appointments, provide initial diagnoses, and manage patient data.

◦ Personalized Treatment: Analyze patient data to create personalized treatment plans, continuously learning from outcomes.

◦ Drug Discovery: Assist in research by analyzing vast datasets and identifying patterns.

• E-commerce and Retail:

◦ Product Recommendations: Refine product suggestions based on user interactions and preferences.

◦ Inventory Management: Manage stock levels and provide real-time updates for orders and inventory.

◦ Customer Experience: Enhance shopping by recommending personalized products and offering real-time order tracking.

• Software Development:

◦ Code Generation: Generate code snippets from natural language inputs and recommend optimizations.

◦ Debugging: Detect and resolve bugs efficiently, speeding up the development lifecycle.

◦ Productivity: Boost technical teams by automating repetitive coding tasks.

• Smart Cities and Infrastructure:

◦ Traffic Management: Regulate traffic flow by managing traffic lights, monitoring congestion, and suggesting alternative routes.

◦ Building Management: Optimize energy use, security, and infrastructure conditions in smart buildings.

• Data Analysis:

◦ Insight Extraction: Process vast datasets to deliver actionable insights for various industries, empowering data-driven decisions.

◦ Database Management: Optimize database management, querying, and analysis with minimal user input, making databases accessible to non-technical users.

What are the key considerations when choosing and implementing an AI agent for a business?

Choosing and implementing the right AI agent requires careful consideration to ensure it aligns with business needs and delivers desired outcomes. Key steps and considerations include:

1. Assessing Needs and Goals:

◦ Identify Specific Tasks: Clearly define what tasks the AI agent will perform. Determine if tasks are simple and repetitive (e.g., basic customer service) or complex, requiring decision-making and adaptability (e.g., complex interactions).

◦ Define Objectives: State the expected outcomes (e.g., improved efficiency, cost reduction, enhanced customer experience, advanced data analysis). For example, a financial trading system optimizing multiple variables would need a utility-based agent.

◦ Understand the Environment: Assess if the operational environment is fully observable, partially observable, static, or dynamic. A dynamic, partially observable environment (like order fulfillment) might benefit from a utility-based agent that monitors real-time status and optimizes workflows.

2. Evaluating Options:

◦ Complexity vs. Functionality: Higher complexity often means greater functionality but requires more resources. Simple reflex agents are easy to implement but limited; utility-based agents are highly complex but offer sophisticated optimization.

◦ Cost: Consider the development, deployment, and maintenance costs. More complex agents (e.g., utility-based) are typically more expensive.

◦ Scalability: Assess if the agent can handle increased workloads or adapt to new tasks without significant changes (e.g., goal-based agents are more scalable for evolving applications).

◦ Integration: Evaluate how well the AI agent can integrate with existing systems and workflows. Seamless data flow is crucial (e.g., a customer service agent integrating with a CRM).

3. Implementation Considerations:

◦ Integration Plan: Develop a plan for seamless integration with existing systems and workflows, ensuring data compatibility and smooth exchange.

◦ Performance Monitoring: Establish mechanisms for continuous monitoring, including tracking Key Performance Indicators (KPIs) like response times and accuracy, and setting up alerts for issues.

◦ Continuous Improvement: Implement feedback loops to refine and enhance the agent's performance over time. Regularly update training data for learning agents to adapt to changing conditions.

◦ Ethical Considerations and Governance: Address data privacy, potential biases, and transparency in decision-making. Ensure the AI agent operates within ethical guidelines and complies with regulations (e.g., data protection laws, fairness standards). Robust security measures and guardrails are essential for responsible deployment.

◦ Specialized Expertise: Recognize that advanced AI agent implementation often requires specialized knowledge in machine learning and data science. Leverage low-code tools or partner with vendors to simplify development and integration.